Why the Marketplace Might Not Be Your Best Option in 2025

- Claire Jaramillo

- Nov 12

- 3 min read

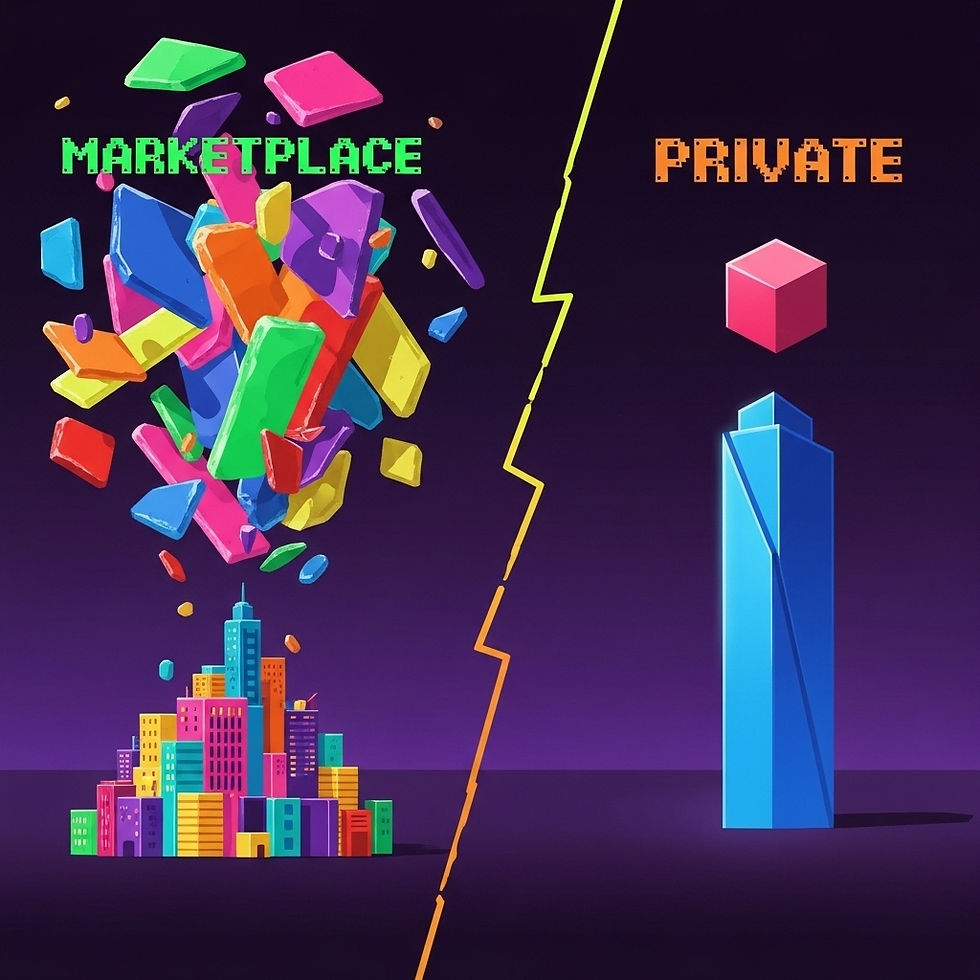

Every year, thousands of people in Hampton Roads sign up for health insurance through the government Marketplace. It feels like the “default” option — but what if I told you it’s not always the best one?

As we move into 2025, Marketplace plans are changing and might not be your best option. Premiums are going up, but coverage isn’t improving to match. For many families, freelancers, and small business owners, that means paying more without getting more.

The good news? You don’t have to settle for Marketplace plans.

The Problem with Marketplace Coverage in 2025

Here’s what I’m seeing as I help clients in Norfolk, Chesapeake, and Virginia Beach review their options:

Rising premiums: Many Marketplace plans are getting more expensive in 2025.

No added value: Even with higher monthly costs, benefits aren’t improving.

High deductibles: Many plans leave you paying thousands out of pocket before coverage kicks in.

Overwhelming choices: With dozens of options listed, most people feel frustrated and confused before they even start.

For people already stretched thin — small business owners, 1099 contractors, or divorced military spouses — these changes make the Marketplace even less appealing.

Why Private Market Plans Are Different

Private market plans aren’t tied to the government Marketplace, which means they often offer more flexibility and affordability.

Here’s why they work so well for people here in Hampton Roads:

Tailored options: Every individual or family gets a plan that fits their needs — no one-size-fits-all.

Budget-friendly choices: Many private plans cost less than Marketplace coverage, even as 2025 rates rise.

Local guidance: You don’t have to figure it out on your own. I walk you through the options.

No added cost for advice: My services are free. Insurance companies pay me, not you.

Real-Life Example: A Norfolk Business Owner

A small business owner in Norfolk came to me frustrated with the Marketplace. He’d tried signing his employees up there, but the premiums were too high and the plans didn’t make sense for everyone on his team.

We looked at private market options instead. Each employee got their own plan that fit their personal needs. The owner saved thousands compared to Marketplace premiums, and his employees felt more secure knowing they had coverage tailored to them.

Who Benefits Most from Private Market Plans?

While private market plans can be a good fit for anyone, they’re especially valuable for:

Small business owners who can’t afford group coverage but want to support employees.

1099 contractors and freelancers with fluctuating incomes.

Divorced military spouses transitioning away from Tricare.

Families looking for coverage that fits their budget and medical needs.

Why Work with a Local Broker Instead of the Marketplace Alone

The Marketplace is designed for the masses. It’s impersonal, confusing, and frustrating to navigate.

As a local broker in Chesapeake, here’s what I do differently:

I listen first. We’ll talk about your needs, not just what’s on a website.

I shop the market. With access to over 100 insurance companies, I find the right fit for you.

I simplify everything. No jargon, no guesswork — just clear options.

I’m here when you need me. Not a call center, not a website — a real person in Hampton Roads.

The Bottom Line

Marketplace plans aren’t always your best bet in 2025. Rising costs and confusing options make it harder than ever to find coverage that actually works for you.

Private market plans give you alternatives that are often more affordable, more flexible, and backed by local support.

If you’re in Hampton Roads — whether you’re self-employed, running a small business, or transitioning after losing Tricare — let’s talk about your options before you settle for the Marketplace.

Comments