The Truth About 2026 ACA Premium Increases — and How Families Can Find Affordable Private Health Insurance Chesapeake VA

- Claire Jaramillo

- Oct 30

- 5 min read

Health insurance costs in Virginia are changing — and 2026 will bring one of the biggest shifts in years. That’s because the enhanced premium tax credits that kept ACA marketplace plans affordable since 2021 are set to expire after 2025, unless Congress extends them.

These subsidies, created under the American Rescue Plan Act and renewed by the Inflation Reduction Act, helped double marketplace enrollment to nearly 24 million Americans.

If they lapse, many families will lose hundreds of dollars a month in federal assistance — and insurers are already preparing for it. Combined with rising medical costs and shrinking carrier participation, ACA premiums in Virginia could increase by 75–100% in 2026.

The good news? You have alternatives. Many Virginians are discovering that private health insurance plans often deliver the same—or better—coverage for far less, with stable rates that aren’t tied to government subsidy programs.

In this guide, we’ll break down what’s causing these premium hikes, what it means for your family’s budget, and how local residents are protecting their coverage through private health insurance in Chesapeake, VA.

Why Are ACA Premiums Increasing So Much in 2026?

For most families, ACA health insurance has been the go-to option for years. But 2026 is shaping up to be a perfect storm of higher costs and shrinking choices.

Here’s what’s driving it:

Expiration of Enhanced Premium Tax Credits (Subsidies): These temporary subsidies—expanded under the American Rescue Plan Act (2021) and the Inflation Reduction Act—are set to end after 2025 unless Congress extends them. They have made coverage more affordable, doubling marketplace enrollment to about 24 million people. Without them, insurers expect a drop in enrollment—especially among healthier individuals—leading to a sicker remaining risk pool and higher average claims costs. This factor alone is cited as contributing 1 to 14 percentage points to the proposed rate hikes in many filings.

Carrier Adjustments: Insurance companies are raising rates due to new claims data and cost-of-care inflation.

Regional Cost Gaps: Areas like Hampton Roads are seeing uneven increases as some carriers exit or limit plan options.

Medical Inflation: The cost of doctor visits, procedures, and prescriptions continues to rise faster than income.

When premiums go up, deductibles and co-pays often follow — meaning you’re paying more and getting less.

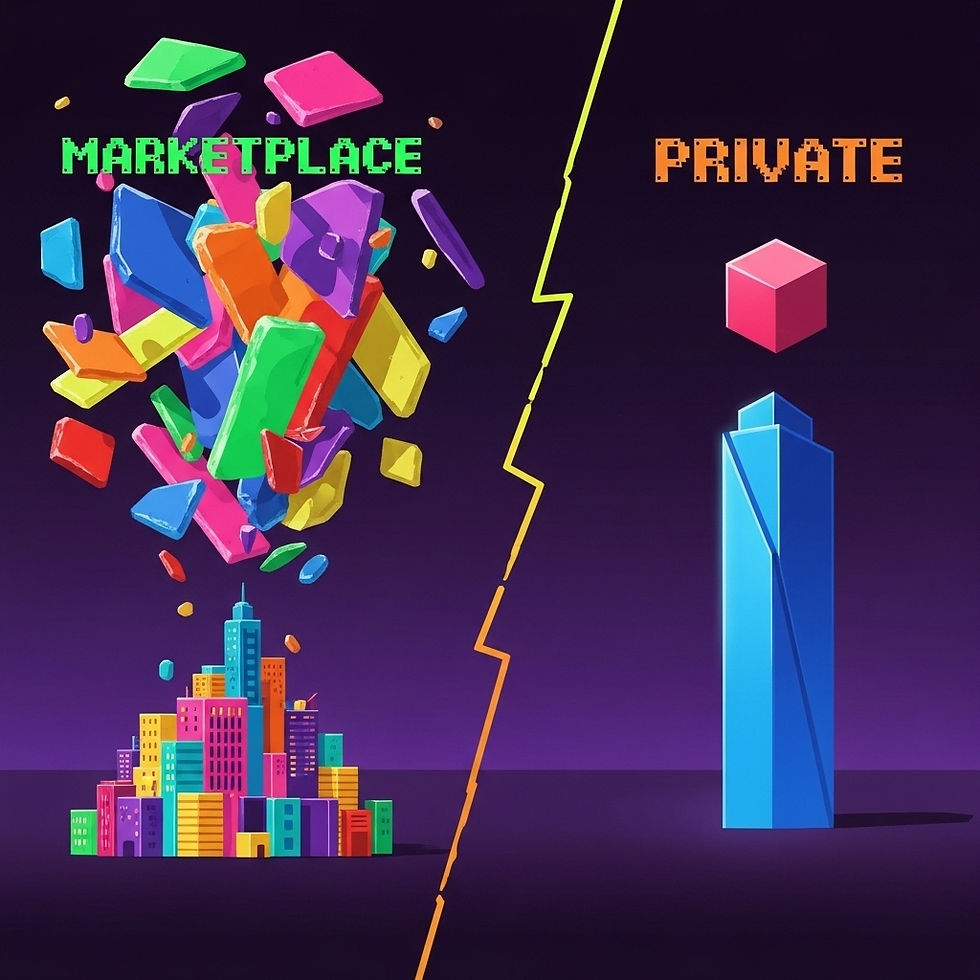

Are private health insurance Chesapeake VA plans cheaper than ACA marketplace plans?

The Answer:

In many cases, yes. Private health insurance plans often offer lower monthly premiums and better control over networks and deductibles.

Unlike the marketplace, private coverage doesn’t rely on subsidies — meaning your costs are stable year to year, not tied to unpredictable federal adjustments.

The key difference? Flexibility. With private coverage, you can tailor benefits around your family’s actual healthcare usage, not one-size-fits-all tiers.

And when you work with an independent advisor like Jason Ruhlman, who compares over 100 carriers, you don’t just get a plan — you get a strategy that fits your life and your budget.

The Hidden Cost of “Staying Put”

Many families stay with their ACA plan because change feels risky. But that comfort can be expensive.

If you’re paying $1,200 a month for coverage and those premiums rise 80% next year, you could face over $20,000 annually in health costs — before deductibles.

Private plans are often hundreds of dollars less each month, with lower deductibles and more predictable costs. And with local help from someone who knows Virginia carriers inside and out, switching doesn’t have to be stressful or confusing.

How Private Health Insurance Works in Chesapeake, VA

Private health insurance is not a government marketplace plan — it’s a customizable policy you select through licensed carriers.

Here’s how it typically works when working with Jason Ruhlman:

Coverage Review: You share your current plan and healthcare needs.

Comparison: Jason runs your details through a database of over 100 companies.

Doctor Verification: Your doctors and prescriptions are checked before enrollment.

Savings Analysis: You see a side-by-side cost breakdown with clear terms.

Activation: Coverage can start in as little as 24–72 hours.

It’s fast, transparent, and completely tailored to Chesapeake families, professionals, and business owners.

How do I know if a private health plan is legitimate?

The Answer:

Legitimate private plans are offered by nationally recognized carriers such as Aetna, Cigna, and Mutual of Omaha — all regulated under Virginia’s insurance laws.

Jason Ruhlman only works with carriers that meet both state and federal compliance standards, ensuring your plan is real, regulated, and renewable.

If you ever see an online ad that seems “too good to be true,” that’s your signal to get advice from a licensed local advisor, not a call center.

The Chesapeake Advantage: Local Guidance You Can Trust

When it comes to healthcare, local matters. Jason lives and works right here in Chesapeake — and he understands the unique healthcare landscape across Hampton Roads.

Why that’s important:

Local doctors and networks vary between Norfolk, Suffolk, and Virginia Beach.

Jason personally verifies which plans align with your current providers.

You get direct support — not an outsourced rep — when you have questions or need help using your benefits.

That’s the difference between buying a policy and building a partnership.

Real-World Takeaway: The Cost of Doing Nothing

If your current plan renews automatically, you might never notice the hidden increases until it’s too late.

Waiting to compare can mean paying thousands more in 2026 for the same care. The easiest way to protect your wallet is to schedule a local plan review before the new rates lock in.

Jason’s clients often describe their first session as “the first time health insurance finally made sense.”

FAQs About Private Health Insurance in Chesapeake, VA

Q: Can I switch to a private plan anytime? A: Yes, in most cases. If you’re leaving a job, losing coverage, or facing rate hikes, you may qualify for immediate enrollment.

Q: Will switching affect my coverage or doctors? A: Jason verifies all provider networks before you switch, so you won’t lose access to your trusted doctors.

Q: Is private health insurance only for high-income families? A: Not at all. Many middle-income families and small business owners qualify for private coverage that beats ACA pricing.

Q: How long does it take to get covered? A: Many plans start within 24–72 hours of enrollment.

Clarity. Coverage. Confidence.

As ACA premiums rise across Virginia, private health insurance in Chesapeake, VA is becoming the smarter, more affordable option.

Families, freelancers, and business owners deserve a plan they understand — not one that drains their budget.

With Jason Ruhlman Health Plan Advisor, you get more than insurance help — you get clarity, confidence, and coverage that fits your life. Schedule an appointment today: https://meetings.hubspot.com/jason-ruhlman?uuid=054522d3-f9ed-4a36-9573-57702ee7faa9

Comments