How to Find Affordable Health Insurance Without Settling for Less

- Claire Jaramillo

- Nov 5

- 2 min read

For many people in Hampton Roads, shopping for health insurance feels like a no-win situation. Either you pay sky-high premiums on the Marketplace, or you settle for a plan that looks “cheap” but leaves you unprotected when you need it most.

The good news? That’s not the only way.

I’m Jason Ruhlman, a local health plan advisor in Chesapeake, and I specialize in helping people just like you find health insurance that’s both affordable and dependable — without the headaches that usually come with it.

Why “Cheap” Isn’t Always Affordable

When people search for affordable health insurance, they often start by looking for the lowest monthly premium. On the surface, that makes sense — who doesn’t want to save money?

But here’s the catch:

High deductibles can leave you paying thousands out of pocket before coverage even kicks in.

Limited provider networks might mean your doctor or local hospital isn’t covered.

Hidden costs like co-pays, prescription limits, and lab fees add up fast.

A plan that looks affordable upfront can actually be the most expensive mistake you’ll make.

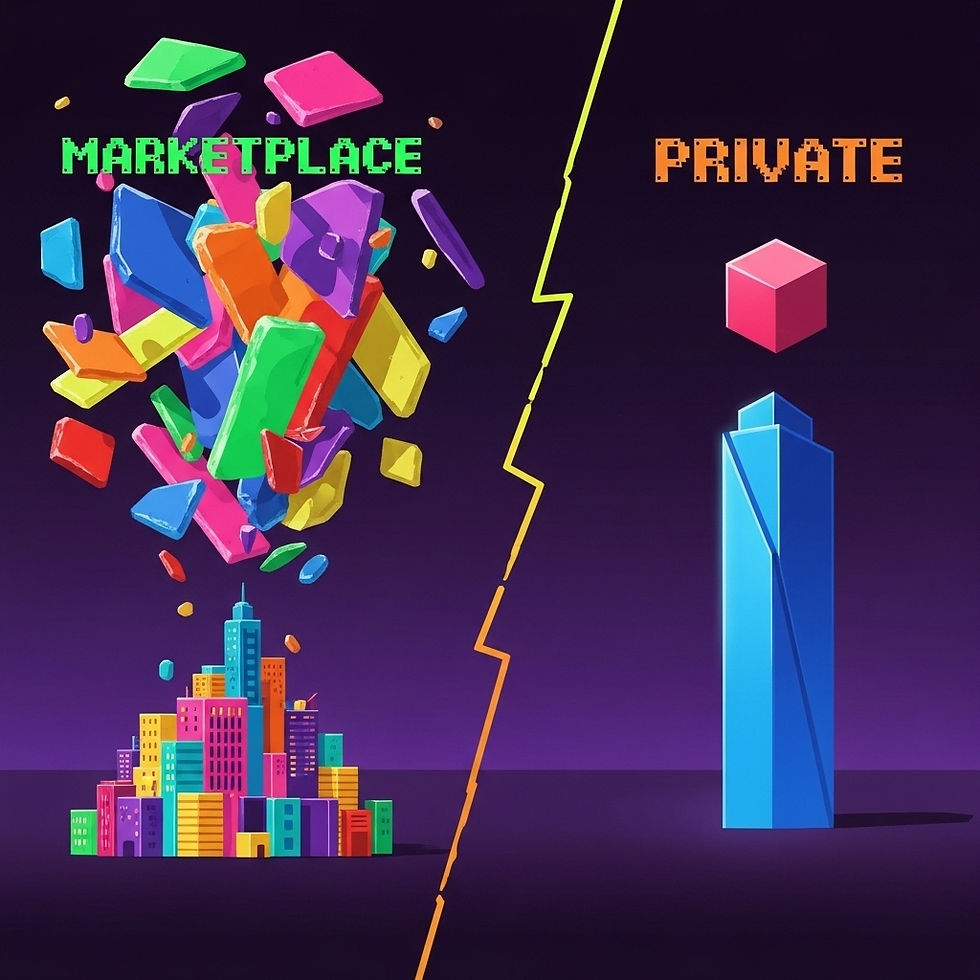

Marketplace Plans Are Getting More Expensive

For 2025, Marketplace premiums in Virginia are going up. Many people in Hampton Roads will find themselves paying more for the same coverage — or worse, less coverage than they expected.

The truth is, you don’t have to be stuck with Marketplace options. The private market offers plans from over 100 insurance companies, many of which provide better coverage at a lower cost.

This is where having someone local — who knows the plans, the carriers, and the community — makes all the difference.

Private Market Health Insurance: A Smarter Alternative

Here’s what I do for my clients:

Shop across 100+ companies to find options you won’t see on your own.

Match plans to your lifestyle and needs, whether you’re a small business owner in Norfolk, a freelancer in Virginia Beach, or a military spouse here in Chesapeake.

Save you hundreds (sometimes thousands) per year by finding coverage that actually works, without the Marketplace markup.

And unlike online portals or call centers, I take the time to walk you through your options so you know exactly what you’re getting.

Local Scenarios I See Every Day

A Norfolk HVAC business owner who thought he had to offer group coverage — but found individual plans for himself and his employees that saved everyone money.

A Virginia Beach freelancer who was overwhelmed by Marketplace options — and ended up with a private plan that cost less and gave her peace of mind.

A Chesapeake military spouse who lost Tricare after divorce — and found a private plan that covered her and her kids without breaking her teacher’s salary.

Different people, same result: affordable coverage without settling.

The Bottom Line for Affordable Health Insurance

Affordable health insurance doesn’t have to mean cutting corners. With private market options and a local advisor on your side, you can have both cost savings and dependable coverage.

If you live in Hampton Roads and you’re tired of choosing between “too expensive” and “not enough,” let’s talk. I’ll make sure you get the coverage that fits — without settling for less.

Comments