How to Compare Health Insurance Without Getting Overwhelmed

- Claire Jaramillo

- Sep 24

- 3 min read

If you’ve ever tried to shop for health insurance, you know how quickly it gets confusing. Deductibles, copays, premiums, networks — by the time you finish comparing a handful of plans, it feels like you’re drowning in jargon.

For people here in Hampton Roads, that confusion often leads to two outcomes:

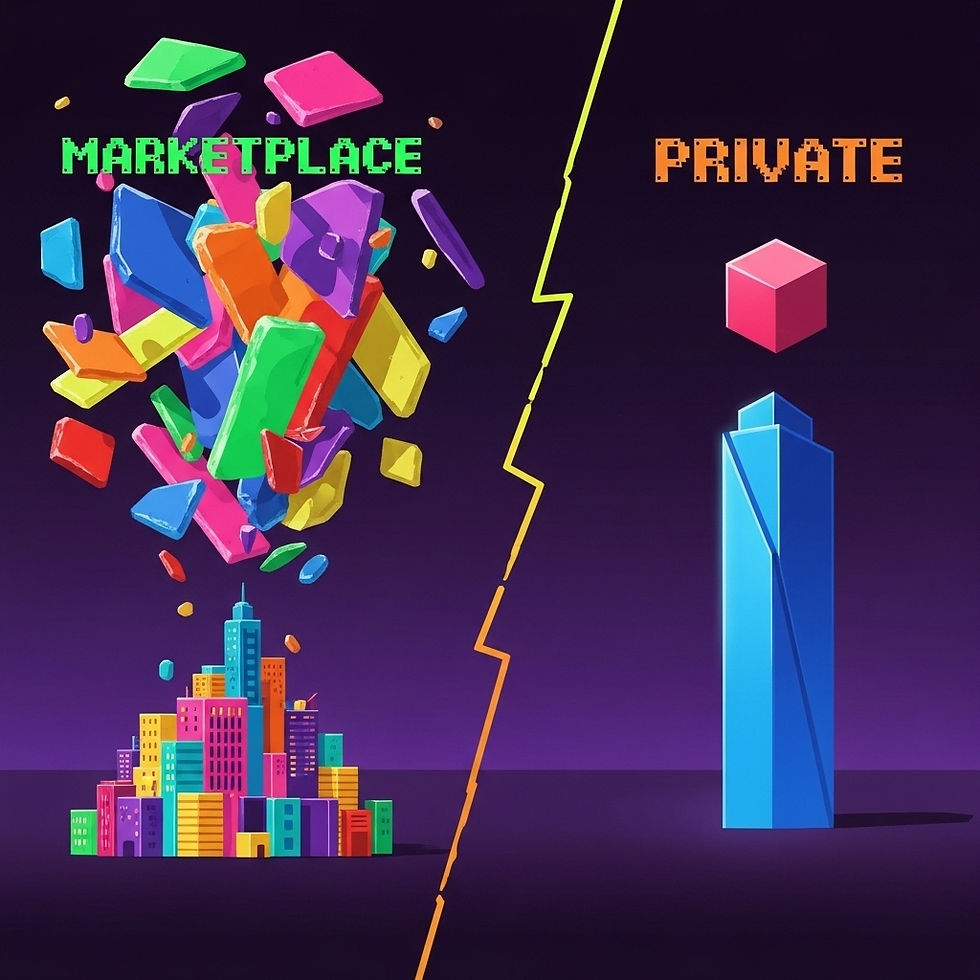

Settling for the Marketplace, even though costs are rising in 2025.

Putting it off altogether, which leaves you without coverage and at risk for massive medical bills.

The truth is, comparing health insurance doesn’t have to be overwhelming. You just need to know what to look for — and where to get help.

Why Comparing Health Insurance Plans Feels Impossible

Here’s why most people get frustrated:

Too many choices: The Marketplace alone lists dozens of plans.

Confusing terms: Deductibles, coinsurance, and networks don’t always make sense.

Hidden costs: A plan that looks cheap on the surface might have high out-of-pocket costs.

No personal guidance: Online tools can’t tell you what works best for your situation.

It’s no wonder so many Hampton Roads families, freelancers, and small business owners end up stuck with a plan that doesn’t actually fit their needs.

The Right Way to Compare Plans

When I sit down with clients in Chesapeake, Norfolk, or Virginia Beach, here’s the process we use to make health insurance simple:

Start with your needs, not the plan. Do you need family coverage? Are you mostly worried about hospital visits? Do you see specialists regularly?

Look beyond the premium. A low monthly cost isn’t always a bargain if the deductible is sky-high.

Check the provider network. If you love your doctor or a local hospital, make sure they’re covered.

Factor in prescriptions. Medications can make a big difference in cost.

Think about flexibility. Life changes — your plan should be able to adjust with you.

Why the Marketplace Isn’t Always Helpful

Marketplace plans don’t make this process any easier. In fact, for 2025, premiums are going up without better benefits, which means the numbers you’re comparing aren’t in your favor.

That’s why I often recommend private market plans instead. With access to over 100 insurance companies, I can pull together options that:

Fit your budget

Cover your actual needs

Provide better value than the Marketplace

Real-Life Example: A Virginia Beach Freelancer

A freelance photographer in Virginia Beach tried to compare Marketplace plans on her own. After hours of research, she still wasn’t sure which one to choose. Every plan seemed either too expensive or too limited.

We met, reviewed her needs, and within an hour I presented private market options that worked for her income and lifestyle. She left with a plan she understood — and peace of mind knowing she was covered.

Why Work with a Local Broker Instead of Doing It Alone

The truth is, you don’t have to be an expert in health insurance. That’s my job.

As a Chesapeake-based broker, here’s how I simplify the process for Hampton Roads residents:

I explain everything in plain English. No jargon, no confusion.

I shop over 100 companies. You’ll see options you won’t find on the Marketplace.

I focus on your needs. Not just the cheapest plan, but the right plan.

I don’t charge you a fee. My services cost you nothing extra.

The Bottom Line

Comparing health insurance doesn’t have to be overwhelming. With the right guidance, you can cut through the noise, avoid costly mistakes, and find a plan that truly works for you.

Whether you’re a small business owner in Norfolk, a 1099 contractor in Virginia Beach, or a military spouse in Chesapeake, I can help you find affordable private market coverage without the stress.

Comments