Health Insurance for Small Business Owners Without Group Plans in Hampton Roads

- Claire Jaramillo

- Oct 1

- 3 min read

If you own a small business in Hampton Roads, you already wear a dozen hats — owner, manager, accountant, marketer. The last thing you need is another complicated decision on your plate.

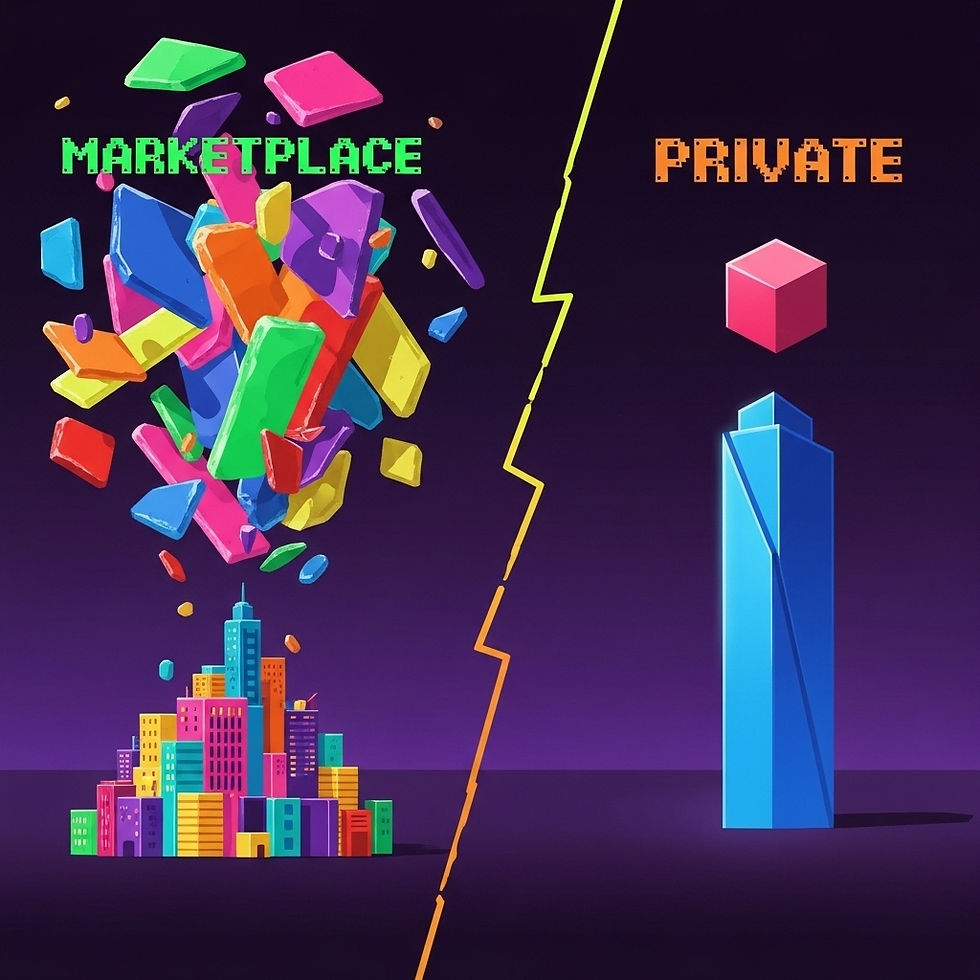

When it comes to health insurance, many small business owners assume they need a group plan to take care of themselves and their employees. But here’s the truth: group plans aren’t your only option.

In fact, for many small businesses, group plans are too expensive, too rigid, and too complicated. That’s where private individual health insurance can be a smarter fit.

Why Group Health Insurance Plans Don’t Work for Many Small Business Owners

If you’re running a contracting company in Norfolk, a family-owned restaurant in Chesapeake, or a boutique in Virginia Beach, you’ve probably looked into group health insurance. And you’ve probably found it comes with problems:

High cost: Premiums for group plans can eat away at your margins.

Minimum participation rules: You may not have enough employees to qualify.

One-size-fits-all: Not every employee has the same health needs.

Complex management: You already have payroll and taxes — adding insurance admin is another headache.

That’s why many small business owners choose a different path.

Private Individual Health Plans: A Smarter Solution

Instead of a group plan, many Hampton Roads business owners protect themselves — and sometimes guide their employees — with private market individual plans. These plans often:

Lower costs compared to group coverage

Provide flexibility so each person can choose what fits them best

Skip the red tape — no participation requirements or complex administration

Offer stronger value than rising Marketplace premiums for 2025

As a broker, I shop over 100 insurance companies to find coverage that fits your budget and lifestyle, without the burden of managing a group plan.

A Norfolk HVAC Owner’s Story

A client of mine who owns a 12-person HVAC business in Norfolk came to me frustrated. He wanted health insurance for himself and his family but assumed he needed a group plan.

The costs were sky-high, and his employees weren’t interested in participating.

We reviewed private individual options, and he walked away with a plan that:

Saved him thousands compared to group coverage

Covered his preferred doctors in Hampton Roads

Gave him peace of mind without the paperwork hassle

Now, instead of worrying about offering group benefits, he focuses on running his business — while knowing his family is protected.

Why Private Market Beats the Marketplace for Owners

The Marketplace may seem like an easy fix, but for 2025, premiums are climbing while coverage isn’t improving. Private market plans give business owners more flexibility, better control, and often lower costs.

And because each employee can choose their own individual coverage (if they want it), you’re not stuck trying to manage everyone’s insurance needs yourself.

How I Help Hampton Roads Small Business Owners

When you sit down with me, here’s how it works:

We focus on you first. What do you and your family need?

We look at private market options. Plans you won’t see on the Marketplace.

We simplify the choice. No confusing jargon, just side-by-side comparisons.

We keep it flexible. If your business grows or your needs change, we can adjust.

And my help doesn’t cost you anything extra.

The Bottom Line

If you’re a small business owner in Hampton Roads, you don’t have to get locked into an expensive group health plan — or settle for the rising costs of the Marketplace. Private individual health insurance can give you the coverage you need without the burden.

I’m Jason Ruhlman, and I help Hampton Roads business owners protect themselves and their families with private market plans that save money and reduce stress.

Comments