Health Insurance for Freelancers in Hampton Roads: Smarter Options Than the Marketplace

- Claire Jaramillo

- Sep 10

- 2 min read

Being a freelancer in Hampton Roads — whether you’re a graphic designer in Virginia Beach, a rideshare driver in Norfolk, or a social media consultant in Chesapeake — comes with freedom, flexibility, and unpredictability. One of the biggest challenges? Health insurance.

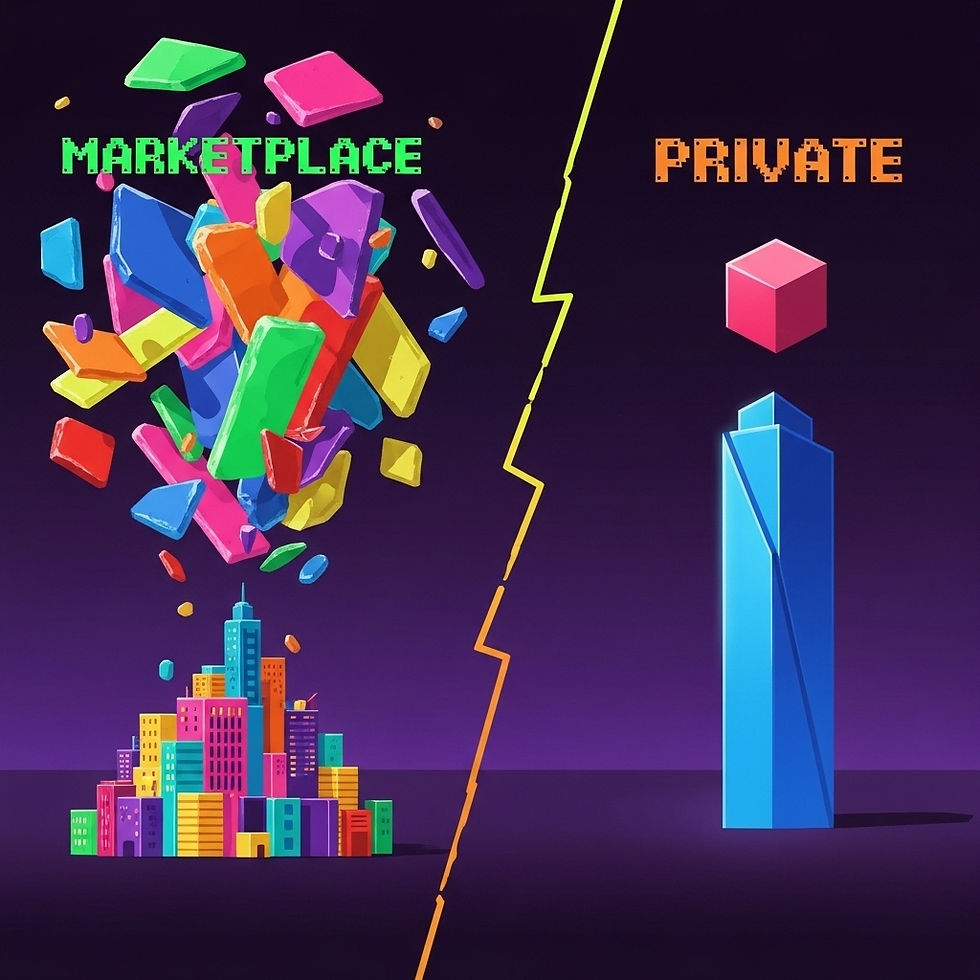

Many freelancers think the Marketplace is the only option. But the truth is, Marketplace plans can be expensive, rigid, and often don’t fit your lifestyle. There’s a better way.

I’m Jason Ruhlman, a health plan advisor in Chesapeake, and I specialize in helping freelancers and independent contractors across Hampton Roads find private market health insurance that’s affordable, flexible, and tailored to their needs.

The Problem with Marketplace Health Insurance Plans for Freelancers

Marketplace plans can seem convenient at first glance. But for freelancers, they often create more stress than relief:

Rising premiums in 2025 can make a “budget-friendly” plan suddenly unaffordable.

One-size-fits-all coverage may not align with your specific needs, like preferred doctors or prescription requirements.

Unpredictable costs for deductibles, co-pays, and out-of-pocket expenses can hurt a fluctuating freelance income.

Complex enrollment and plan selection takes hours you could spend on work or family.

When your income is variable, you need flexibility — not rigid Marketplace rules.

Why Private Market Plans Can Be Smarter for Freelancers

Private market health insurance offers freelancers advantages the Marketplace doesn’t:

Lower monthly premiums compared to rising Marketplace rates.

Plans that fit your lifestyle, covering what you actually need and skipping what you don’t.

Access to local doctors and hospitals across Hampton Roads.

Flexibility if your income fluctuates month to month.

With over 100 insurance companies in my network, I can show you options that are often cheaper, better, and easier to understand than anything on the Marketplace.

A Virginia Beach Freelancer’s Story

One client, a freelance social media consultant in Virginia Beach, was overwhelmed by Marketplace options. Every plan she reviewed seemed either too expensive or left her feeling under covered.

After we reviewed private market options, she chose a plan that:

Reduced her monthly premium

Covered her preferred local doctors

Protected her in case of medical emergencies

She walked away feeling confident, knowing she had a plan that worked with her lifestyle and budget, not against it.

How I Help Freelancers in Hampton Roads

Here’s how I guide freelancers through health insurance:

Start with your needs. Do you travel? Take regular medications? Need specialist access?

Compare private market options. Plans you won’t see on the Marketplace.

Break down costs clearly. Know your monthly premium, deductible, and potential out-of-pocket expenses.

Provide ongoing support. If your freelance income changes, we adjust your plan.

And the best part — my help doesn’t cost you anything extra.

The Bottom Line

You don’t have to settle for expensive, rigid Marketplace plans. Freelancers in Hampton Roads have private market options that save money, protect their health, and fit their lifestyle.

I’m Jason Ruhlman, a Chesapeake-based health plan advisor. I help freelancers and independent contractors find coverage that works — without the stress.

Take control of your health insurance costs today. Call Jason at 757.632.7567 or schedule your free consultation online: https://meetings.hubspot.com/jason-ruhlman?uuid=7f6542ba-39e1-4794-b8ef-21d1e826a03f. Let's find you coverage that protects both your health and your budget.

Comments