Marketplace Health Insurance Costs Are Rising in 2025 — Here’s What You Need to Know

- Claire Jaramillo

- Oct 8

- 2 min read

If you live in Hampton Roads and are planning to renew or sign up for health insurance in 2025, there’s something important you should know: Marketplace premiums are going up.

That means many families, freelancers, and small business owners in Chesapeake, Norfolk, and Virginia Beach could end up paying more each month without seeing any improvement in their coverage.

The good news? The Marketplace isn’t your only option.

What’s Happening with the Marketplace

Each year, Marketplace health insurance plans adjust their pricing. For 2025, health insurance costs are rising — but the coverage isn’t keeping pace. This leaves many people frustrated:

Higher monthly premiums without better benefits

Limited flexibility in plan design

Doctor and hospital network restrictions that don’t always fit your needs

Why This Matters for Hampton Roads Residents

Here in Hampton Roads, many people fall into three groups that are especially impacted by Marketplace changes:

Small business owners who don’t want the expense of group plans

1099 contractors whose incomes fluctuate month to month

Military spouses transitioning off Tricare after divorce

For these groups, Marketplace plans can feel too rigid, too expensive, and too confusing.

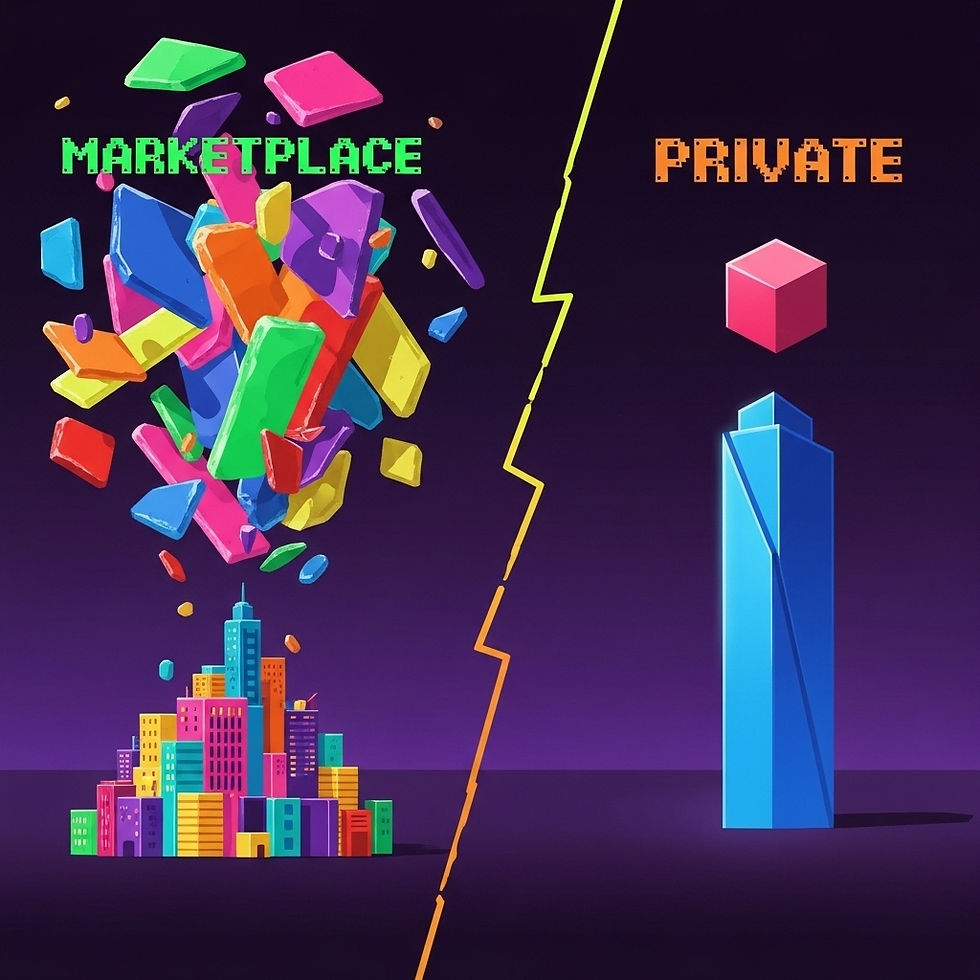

The Private Market Alternative

This is where private health insurance comes in. Unlike the Marketplace, private plans give you more flexibility to find coverage that fits your life and budget.

As a Chesapeake-based broker, I work with over 100 insurance companies. That means I can compare options you won’t see on the Marketplace, often finding:

Lower monthly costs than Marketplace premiums

Coverage tailored to your needs (not one-size-fits-all)

Networks that include your local doctors and hospitals

Plans that grow with you as your life changes

A Norfolk Family’s Experience

One family in Norfolk came to me frustrated after comparing Marketplace plans for 2025. Their monthly premium was set to increase by nearly $300 — and their children’s pediatrician wasn’t even in-network.

After reviewing private market options, we found a plan that:

Cut their premium costs significantly

Kept their trusted pediatrician covered

Reduced their out-of-pocket risk in case of emergencies

They walked away relieved, knowing they had coverage that fit both their budget and their family’s needs.

Why Work with a Local Advisor

The Marketplace doesn’t give you personalized guidance — it gives you lists of plans to sort through. That’s why so many people feel overwhelmed.

When you work with me, here’s what you get instead:

Plain-English explanations of what each plan actually covers

Side-by-side comparisons of private and Marketplace options

Local expertise from someone who understands Hampton Roads healthcare providers

No extra cost — my services are free to you

The Bottom Line

Marketplace premiums are rising in 2025, and sticking with those plans could mean paying more for less. But you don’t have to settle.

Private health insurance plans give Hampton Roads residents real alternatives — often with lower costs, more flexibility, and coverage that actually fits your life.

I’m Jason Ruhlman, and I help individuals, families, and business owners across Chesapeake, Norfolk, and Virginia Beach save money and find peace of mind with private health insurance.

Comments